One of the unexpectedly important yet seemingly trivial tasks for expats is tracking your presence both in Spain and elsewhere as a means to determine tax obligations and meet residency requirements. Learn how to count your days, confirm the requirements for your residency situation, and review the technologies available to help you.

If you hold this visa, you must stay in Spain for 183 days out of each year to maintain your residency. This automatically makes you a tax resident of Spain, so be aware that this visa will have tax consequences for you

Residency in Spain can be a complicated topic for expats, and one of the elements that proves most confusing is the calculation of days in-country. How many days can you be absent from Spain and still be a resident? How long can you spend in other Schengen countries? And how do you manage to keep track of your travels?

The number of days you can be outside of Spain and still maintain your residency varies by your visa type. Worse, because of the EU’s open borders, if you do venture out to another Schengen country, it’s likely you won’t have stamps in your passport to help you determine your days in Spain or in the Schengen area while you are outside of Spain.

This article aims to dispel some of the fog around the topic, help you understand what you need to know, and give you some guidance on useful apps to help you track your time inside and outside of Spain.

Each visa type has its own limitations regarding how many days one can be outside of Spain and still maintain one’s residency. Find your visa type below (either planned or current) in order to discover how many days you can leave Spain and still be considered a resident under that visa.

If you’re just visiting Spain as a tourist (someday, post-pandemic, if we can assume this will be possible again), Spain counts as one of the countries where you can travel for 90 out of every 180 days, according to the Schengen area agreement. You won’t need to keep track specifically of your days within Spain, but you must not exceed 90 out of every 180 days in Schengen countries overall (including Spain). If this describes your situation, you can ignore the other visa categories, but you might want to jump down to the list of apps to help you track your time in the Schengen area. Now, let’s get into the temporary residency visas.

A very popular visa type for expats in Spain for the last several years has been the Non-Lucrative Visa, or NLV. This visa is intended for retirees and other people who have savings or passive income from investments (such as stock dividends). (Many remote workers have used this visa as well, but doing so is now officially frowned upon by the Spanish immigration authorities, who have been refusing to grant Non-Lucrative Visas on the basis of work-based income for the past few years.) If you hold this visa, you must stay in Spain for 183 days out of each year to maintain your residency. This automatically makes you a tax resident of Spain, so be aware that this visa will have tax consequences for you, even as the citizen of another country.

If you are employed by a Spanish company, or by an international company with offices in Spain, then you will be able to reside in Spain for the length of your contract under an Employment Visa. The Self-Employed or autónomo visa is also a well-known option for people from outside the EU who wish to work independently in Spain. To obtain this type of visa, you must show that you have contracts to support yourself according to the requirements of the visa. As with the Non-Lucrative Visa, in order to renew your residency, holders of the Employment Visa or Self-Employed Visa will need to be resident in Spain for a minimum of 183 days out of each year. Obviously, as an employee, you will have Spanish taxes withheld for you, and as a self-employed person, you will already be paying taxes, so being a resident for tax purposes is moot under this type of visa.

If you’re a college student or English teaching assistant (Auxiliar de Conversación), you may have the option to convert your visa to another type, such as a working visa, self-employment visa, or jobseeker visa, once you have lived in Spain for three years. If you’re hoping to make your residency permanent in the future, you’ll want to watch the amount of time you spend outside of Spain. If you want to make Spain your long-term home, you must be in Spain for 183 days out of each calendar year for which you will eventually want to claim residency. If your intention is just to reside in Spain on a student visa while you teach or study, without regard to your long-term status in Spain, then you needn’t pay much attention to how many days you are in Spain; however, you will still need to track your time while you’re outside of Spain, to make sure you don’t exceed 90 out of each 180 days in the Schengen area.

The Entrepreneurial Visa is probably the most difficult Spanish visa to obtain. You must submit a detailed business plan to show that you are prepared to invest significantly in an innovative business that will create jobs and give a boost to the Spanish economy. Similar visas exist for those individuals with the resources to make an investment in an existing business in Spain. The investment must be a minimum of one million Euros (or two million Euros invested in public debt), putting this type of visa out of reach for most people of ordinary means. According to immigration lawyer Ainhoa Manero of the law firm Sterna Abogados, under the terms of the Entrepreneurial Visa, you must be in Spain for six months out of each calendar year in order to renew your residency. However, for the other two similar investment-type visas, residence in Spain for a minimum of six months out of the year is not required. You must simply be inside Spain for at least one day each year, presumably not a difficult task for the jetsetters among us!

The Golden Visa requires a purchase of one or more properties in Spain by the visa applicant, worth at least 500,000 Euros total. As with the Investment Visa, holders of the Golden Visa do not need to spend six months out of the year in Spain; they can travel within the Schengen area for 90 out of 180 days of the year, and also go elsewhere at liberty, within the limitations noted in the following section on permanent residency. However, they do need to be inside Spain for at least one day each year, which is sufficient as long as they aren't interested in long-term residency and eventual citizenship. See below for more on that subject ...

Golden visas offer some of the most flexible presence requirements.

Golden visas offer some of the most flexible presence requirements.If you plan to repeatedly renew your temporary residency permits and thus earn permanent residence, your presence in Spain must be nearly continuous over five years. The maximum you can be outside of Spain over five years of residency is 10 months, total. If you have been absent from Spain for more than 10 months out of the last five years, your application for permanent residency may be denied. In addition, continuous absence from Spain for 12 months or more in the last five years can actually cancel your non-permanent residency. Even if you own property or have other ties in Spain (aside from marriage or family ties), you would need to apply for a new visa to return. In fact, a similar requirement applies even for permanent residents, who must ensure they are not absent for more than 12 continuous months over any five-year period in order to avoid losing permanent residency. A slightly different situation applies if you are a citizen of a former Spanish colony (all the South and Central American countries that were colonized by Spain, Equatorial Guinea, or the Phillipines); you can apply for Spanish citizenship after only two years of continuous residency in Spain, instead of the usual amount of time (ten years). According to Ainhoa Manero of Sterna Abogados, such applications are decided by judges, who have more leeway for their decisions than do immigration officials. So, the number of months you could be absent from Spain during those two years can vary. But as a general rule, you should be careful not to be absent more than three to four months out of the two years total, as it's most important to demonstrate your Spanish connections and integration into Spanish life and culture.

As mentioned above, a non-EU citizen holding a 90-day Schengen travel visa is allowed to be in the Schengen area without a residency visa for only 90 out of each 180 days, regardless of calendar year. If you have a Spanish residency permit, your time in Spain does not count against the Schengen limit. But as soon as you leave Spain’s borders and enter a Schengen country, the 90-day Schengen “countdown” begins, and you will need to ensure that you don’t overstay those Schengen limits.

Fortunately, apps exist that can help you keep track and stay on the right side of Spanish residency visa laws.

It could be argued that with the EU’s seamless travel norms (pre- and presumably post-pandemically speaking), there’s no way for the authorities to know that rather than being in your normal residence in Spain, you nipped off to Bordeaux or Berlin for a few months. However, this is not a wise assumption to make. The penalties are just too significant. You could find yourself banned from the EU entirely for a number of years, asked to pay a steep fine, or both. Or, if nothing were to happen right away, you might breathe easy, thinking you’ve gotten away with a Schengen violation -- only to find it biting you a few years later when you want to make your residency in Spain permanent.

But, you might ask -- how would they ever know? Good question. Remember that you leave clues everywhere, and that multiple sources of information about you in Spain are tied to your NIE number. For instance, the electric bill for the apartment you lease in Spain, conveniently pulled out of your bank account every month? If that bill stops for three months here and four months there because you’ve skipped town to hang out in another EU country, that information is easily traceable by the Spanish government, and therefore available to the Schengen authorities. They may require bank account statements as well (although the official required documentation list indicates a bank statement is only part of your evidence of financial means). A bank statement would show your spending, wherever it occurred. In short, be extremely careful about your electronic and financial trails. It’s not as easy as it used to be.

In sum, it’s very important to keep track of how long you spend outside of Spain for the long term. Fortunately, apps exist that can help you keep track and stay on the right side of Spanish residency visa laws. We’ll highlight our top three here.

TrackingDays™ (Lauco Trading Ltd.)

Download: Tracking Days website

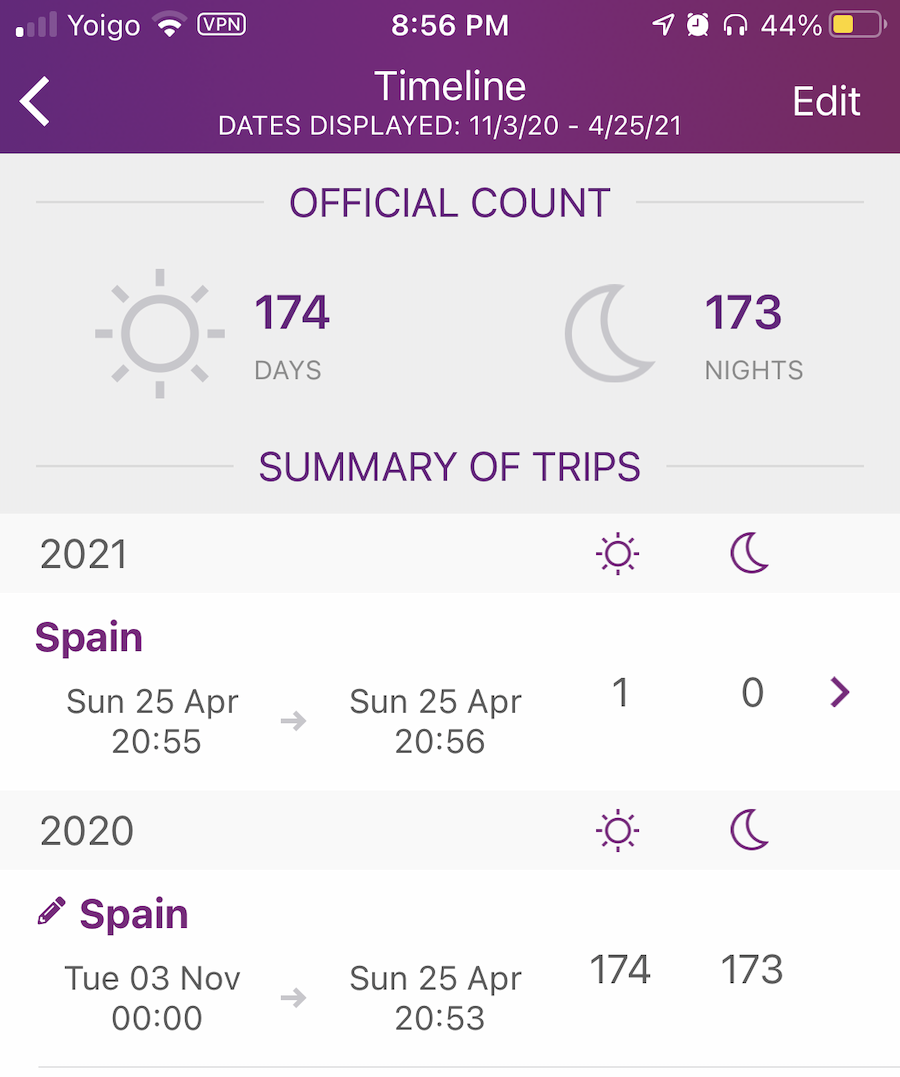

TrackingDays™ was once free, leading to its popular adoption among expats looking to effortlessly track their travels. It is now a paid app, but the reasonable fee ($3.99/mo or $41.99/yr) buys you the peace of mind of knowing precisely how many days (and nights) you’ve spent where. The company offers a one-month free trial as a courtesy, but you’re likely to want this app for the long haul. You can even add in trips and locations after-the-fact, and TrackingDays will track them for you in your trip History, along with your current travel in your Timeline (in which the app tracks your location automatically). You do need to keep TrackingDays running at all times when you need to track your presence. It is not an intrusive app, nor does it drain battery life; but you will need to regularly make sure that it’s running. Note that this app is available only in the Apple App Store; there is no Android version.

TRVL (Cyril Chandelier)

TRVL in Apple App Store, 5.0 Rating. (No Android version available.)

Download: TRVL in the iOS App Store

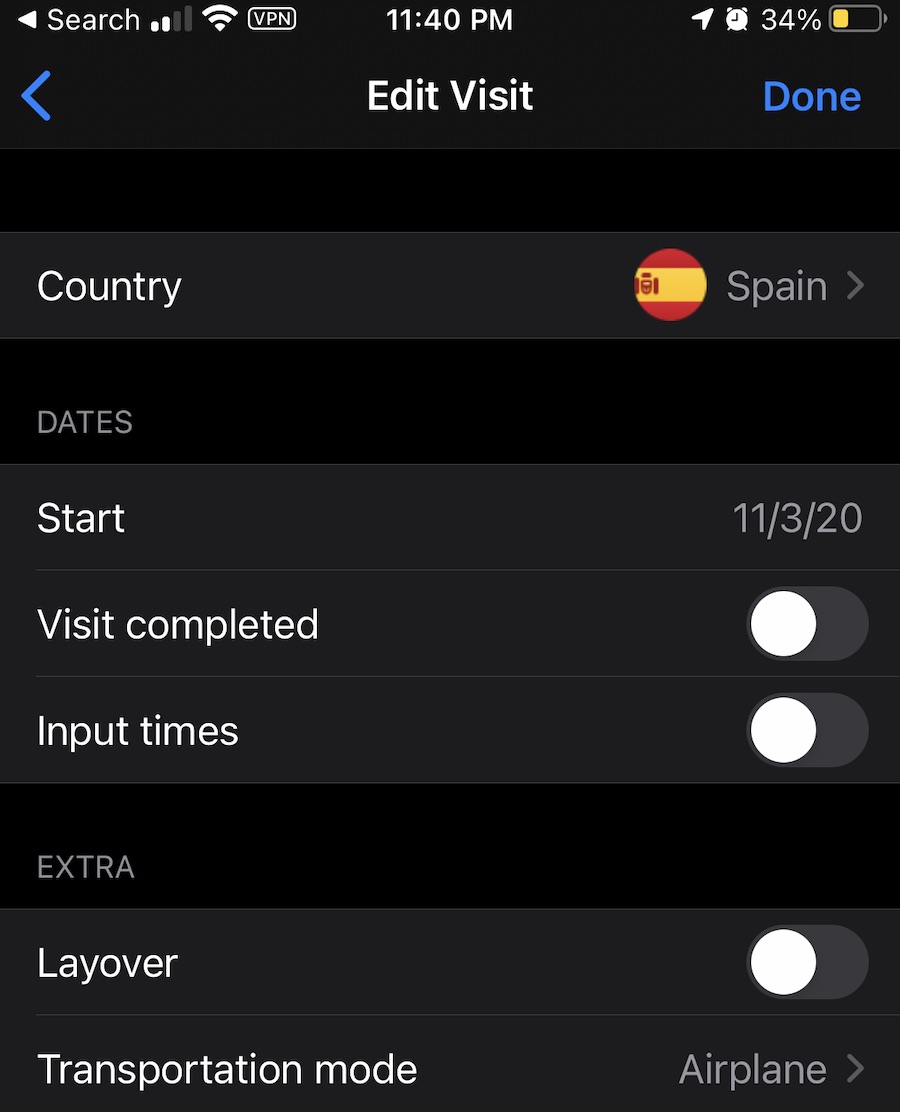

TRVL, like TrackingDays, turns your iPhone into your personal country presence tracker. Just as with TrackingDays, it will track your travels as long as your iPhone is on and the app is running. (With TRVL, you can also set the app to track your location while it’s not running.) The Pro version ($2.99) lets you access day counts by country; group day counts by calendar year; and email a list of countries you have visited (to share with, perhaps, your immigration lawyer or your tax professional). TRVL improves on TrackingDays by allowing you to enter an arbitrary “start date” for any trip, even one that’s been automatically tracked. (So, no painstakingly-slow adding of days from the past.) You can include extra data like your transportation mode for a trip, and also mark a stop in a country as a layover (great for those EU connector flights from the US to Spain). Note that this app is available only in the Apple App Store; there is no Android version.

MONAEO (Monaeo)

Apple App Store, 4.0 Rating; Google Play Store, 4.1 Rating.

Download: iOS App Store link or Google Play Store link

Unlike our top two contenders, MONAEO is not a standalone app, but a companion to a broader tax compliance service for business travelers. As such, it requires login as soon as you start the app. At the cost of $99 per month for individuals, this app is a step above the others, providing “audit-tested” automated trails for presence at the city, state and country levels, as well as tax related data, expense management, and more. It also boasts secure storage of your data for audit-trail purposes and secure communication from Monaeo’s servers to your device. Because they can incur more significant tax consequences, as well as having more freedom to travel outside of Spain for longer periods of time, those fortunate holders of the Golden Visa, Entrepreneurial Visa or another investment-level visa may find this app most useful. In addition, someone who simply needs an Android app rather than iOS, or anyone who wants their data encrypted for extra security, may find this app worth the investment.

Honorable mention goes to Residays (Dmitriy Tomisonets, 5.0 Star Rating in the Apple App Store), which was designed to provide a “countdown to residency” based on your country of origin and your country of intended residency. Its Apple App Store rating is reassuringly high, but there are only two ratings, and the last update was three years ago. You can download Residays at: iOS App Store. Another honorable mention to the Schengen Calculator (Vitaliy Golubenko, 3.3 Star Rating in the Apple App Store). It’s right on target for those just needing to manage their time in the Schengen area without regard to tracking their time in Spain specifically, and unlike Residays, it’s been updated fairly recently (8 months ago). But its relatively low rating and somewhat limited functionality left it out of our main contenders list. If you want to give it a try, you can download the Schengen Calculator at the App Store: iOS App Store link.

A large number of more general-purpose day counters might be useful for tracking your days in a country, and exist for both iOS devices and Android by the dozen. Most of these apps let you track the number of days of X (sobriety, yoga sessions, meditation) or count down the number of days to Y (anniversaries, wedding dates, birthdays). Any of them could be tweaked to purpose just by some clever tracker-naming. In addition, there are lots of travel diary apps and similar; while not expressly advertising themselves as location-trackers, they could be used that way. For example the nifty and multi-purpose TravelLog (Meagan Sanchez, 5.0 Star Rating in the Apple App Store) might be just the thing, and is a travel diary as well as a tracker. But it’s relatively new, and only has one review. The similarly-named, similarly multi-functional TraveLog (Panterra, 4.2 Rating in the Google Play Store with more than 1,000 installations) looks very promising, but we were unable to test it at this writing.

Speaking of Android apps, it must be noted that there are numerous highly rated Schengen and Visa-related apps available in the Google Play Store that are compatible solely with Android devices. Our apologies to fans of these apps, but we were unable to test any of them. If we promise to do a follow-up article rounding up the best Android apps for Spain, Visa and Schengen-tracking purposes, do you promise not to be too mad at us? (Even better, send us your recommendations!)

Add a comment

Sign-up to post a comment…